DCX Systems Limited IPO Latest GMP Review Allotment

DCX Systems Limited GMP Is (78+) is among the main Indian players in the production of electronic sub-frameworks and link outfits. The organization started tasks in 2011 and has been a favored Indian Balanced Accomplice ("IOP") for unfamiliar unique hardware makers ("OEMs") for executing aviation and guard producing projects.

In 2020, the organization dispatched another assembling office at the Hello Tech Safeguard and Aviation Park SEZ in Bengaluru, Karnataka.

As of June 30, 2022, DCX Frameworks had 26 clients in Israel, the US, Korea and India, including specific Fortune 500 organizations, worldwide partnerships and new companies. The organization's clients incorporate homegrown and worldwide OEMs, privately owned businesses and public area endeavors in India across various areas, going from protection and aviation to space adventures and rail lines.

DCX Framework's key clients incorporate Elta Frameworks Restricted, Israel Aviation Ventures Restricted - Framework Rockets and Space Division, Bharat Hardware Restricted, and Astra Rafael Comsys Private Restricted, among others

In Monetary 2020, 2021 and 2022 and in the three months finished June 30, 2021, and June 30, 2022, DCX Frameworks' income from tasks was Rs. 4,492.62 million, Rs. 6,411.63 million Rs. 11,022.73 million, Rs. 1,229.14 million and Rs. 2,132.54 million, separately.

The organization's business verticals:

1. Framework integrationin areas of radar frameworks, sensors, electronic fighting, rockets, and correspondence frameworks.

2. Link and Wire Bridle Gatherings.

3. The organization supplies get together prepared units of electronic and electro-mechanical parts.Company Financials

Objects of the Issue

The organization proposes to use the Net Returns of the New Issue towards subsidizing the accompanying articles:

1. Reimbursement/prepayment, in full or part, of specific borrowings profited of by the Organization.

2. Subsidizing working capital prerequisites of the Organization.

3. Interest in our entirely claimed Auxiliary, Raneal Progressed Frameworks Private Restricted, to support its capital consumption costs.

4. General corporate purposes.

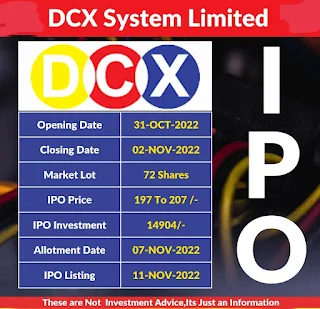

DCX Systems Limited public offering Subtleties

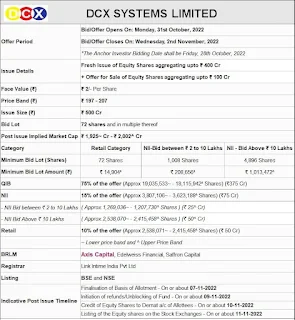

Initial public offering Date Oct 31, 2022 to Nov 2, 2022

Posting Date [.]

Face Value ₹2 per share

Price ₹197 to ₹207 per share

Parcel Size 72 Offers

Issue Size [.] portions of ₹2

(collecting up to ₹500.00 Cr)

New Issue [.] portions of ₹2

(conglomerating up to ₹400.00 Cr)

Offer for Sale [.] portions of ₹2

(conglomerating up to ₹100.00 Cr)

Issue Type Book Assembled Issue Initial public offering

Posting At BSE, NSE

QIB Offers Offered Not under 75% of the Deal

NII (HNI) Offers Offered Not over 15% of the Deal

Retail Offers Offered Not over 10% of the Proposition

Organization Advertisers

NCBG Possessions Inc and Vng Innovation Private Restricted are the organization promoter.DCX Frameworks Initial public offering Speculative Plan

DCX Frameworks Initial public offering opens on Oct 31, 2022, and closes on Nov 2, 2022. The DCX Frameworks Initial public offering bid date is from Oct 31, 2022 10.00 A.M. to Nov 2, 2022 5.00 P.M. The Deadline for UPI Order affirmation is 5 PM on the issue shutting day.

Event Tentative Date

Opening Date Oct 31, 2022

Shutting Date Nov 2, 2022

Premise of Allotment Nov 7, 2022

Inception of Refunds Nov 9, 2022

Credit of Offers to Demat Nov 10, 2022

Posting Date Nov 11, 2022

DCX Systems Limited public offering Part Size

The DCX Frameworks Initial public offering part size is 72 offers. A retail-individual financial backer can apply for up to 13 parts (936 offers or ₹193,752).

Application Lots Shares Amount

Retail (Min) 1 72 ₹14,904

Retail (Max) 13 936 ₹193,752

S-HNI (Min) 14 1,008 ₹208,656

B-HNI (Min) 68 4,896 ₹1,013,472

DCX Systems Limited public offering Advertiser Holding

Pre Issue Offer Holding 98.20%

Post Issue Offer Holding 73.58%

DCX Frameworks Initial public offering Survey

Off late, we are seeing rising extravagant for safeguard counters and, surprisingly, the Public authority of India has mooted numerous drives to support this area. With "Make in India", "Atmanirbhar Bharat", and other changed approaches, DCXSL - the most favored Indian offset accomplice - is ready for splendid possibilities. In light of its monetary exhibition, the issue shows up sensibly valued. Financial backers might think about putting resources into this issue for the medium to long haul rewards.

DCX Systems Limited public offering GMP Today

The present GMP for DCX Frameworks Initial public offering is ₹78(+/ - ). The Initial public offering current dark market premium was keep going refreshed on Oct 28th 2022 10:06 AM. The cap cost for DCX Frameworks Initial public offering is 207. The assessed posting cost for DCX Frameworks Initial public offering as of current GMP is ₹285. The normal addition/misfortune per share as far as rate is 37.68%.

We are following DCX Frameworks Initial public offering GMP for the last 7 meetings. The most reduced GMP for DCX Frameworks Initial public offering is ₹40 and the most elevated GMP is ₹80. The ongoing GMP (₹78) is showing signals towards the lower side. With this pattern, it can go further down on posting day.

0 Comments